Date Of Last Update: September 2023

The regulatory use of ratings in Switzerland is mainly defined by Swiss Financial Market Supervisory Authority FINMA. Unlike in the EU, there is no formal registration process for rating agencies in Switzerland. Rating agencies are given the possibility to apply for recognition as an External Credit Assessment Institute (ECAI) only. According to international regulatory practice, FINMA determines the specific rating segments of recognized ECAI’s that can be used for regulatory capital requirements in consideration with domestic needs.

The FINMA Circular 2012/1 on Credit Rating Agencies entered into force on January 1st 2012 and can be found here.

Registered or Certified Rating Agencies

Currently, the following Rating Agencies are recognized by FINMA in Switzerland:

- AM.Best Rating Services

- DBRS

- fedafin AG

- Fitch Ratings

- Moodys Investors Services

- Scope Ratings

- Standard & Poors

The recognition is granted separately for the 3 broad market segments “public finance”, “commercial entities” and “structured Finance”, which can be looked up following this link.

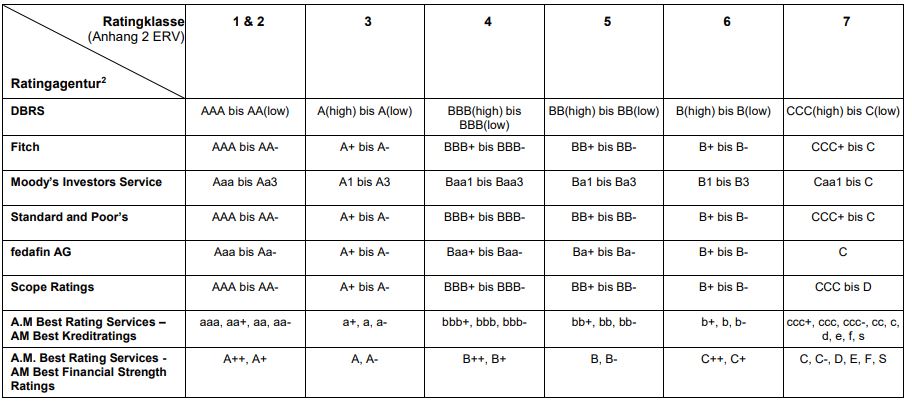

Mapping

Long term Ratings from the above agencies are mapped by FINMA onto the 7 credit quality steps applicable to banks in Switzerland as follows: