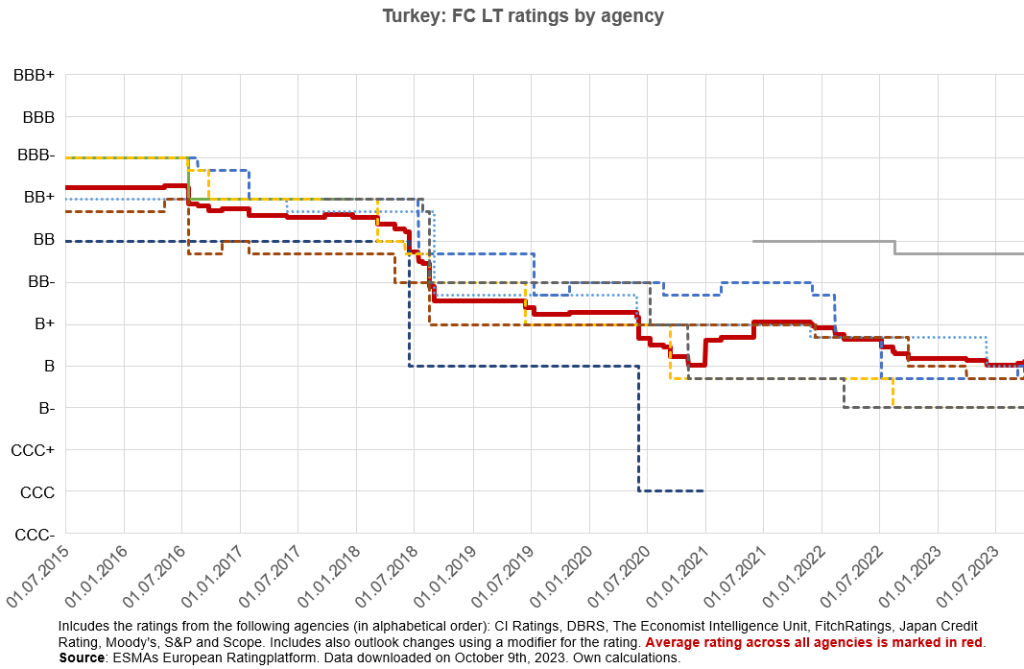

Given that Turkey’s National Day on October 29th is approaching, we take here a look onto how Turkey’s sovereign rating has evolved in recent years.

Data used

Our analysis is based on the rating information available on ESMAs European Ratingplatform (“ERP”). Credit rating agencies registered or certified with ESMA need to report their rating actions on a daily basis to ESMA so that these can be made available to the public in accordance with the CRA Regulation as amended in 2013.

Rating activity data at ERP are available from July 2015 onwards. According to ERP, the following 8 agencies rate (or rated) Turkey (in alphabetical order): CI Ratings, DBRS, The Economist Intelligence Unit, FitchRatings, Japan Credit Rating, Moody’s, S&P and Scope. We downloaded the data from ERP on October 9th, 2023.

Rating evolution

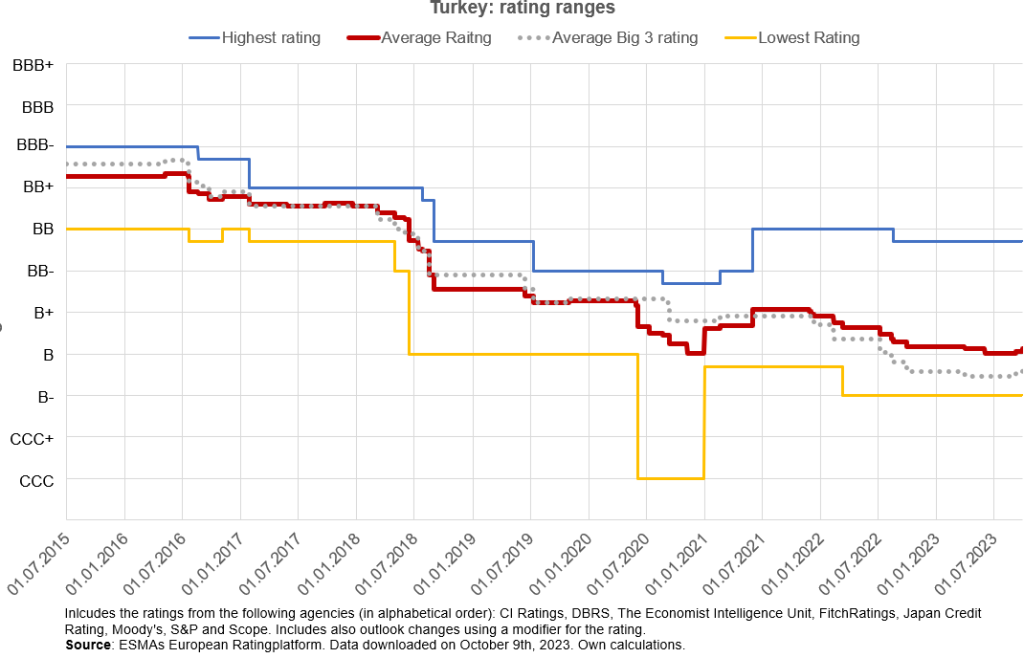

The graph above outlines how the long-term foreign currency ratings on Turkey evolved from July 2015 onwards. The graph includes a modifier to cover for the outlook. Given proprietary rights of the rating data, we are not disclosing the names of the individual agencies.

As can be seen from the graph, Turkey’s sovereign rating deteriorated over the whole period, most agencies currently rating Turkey at B or B-, so in the highly speculative region.

Rating ranges

The graph below summarizes the ratings of the 8 agencies:

Next to the highest and lowest rating across all agencies, the graph displays the average rating by the 8 agencies as well as the average rating by the Big 3 agencies (S&P, Moodys and Fitch).

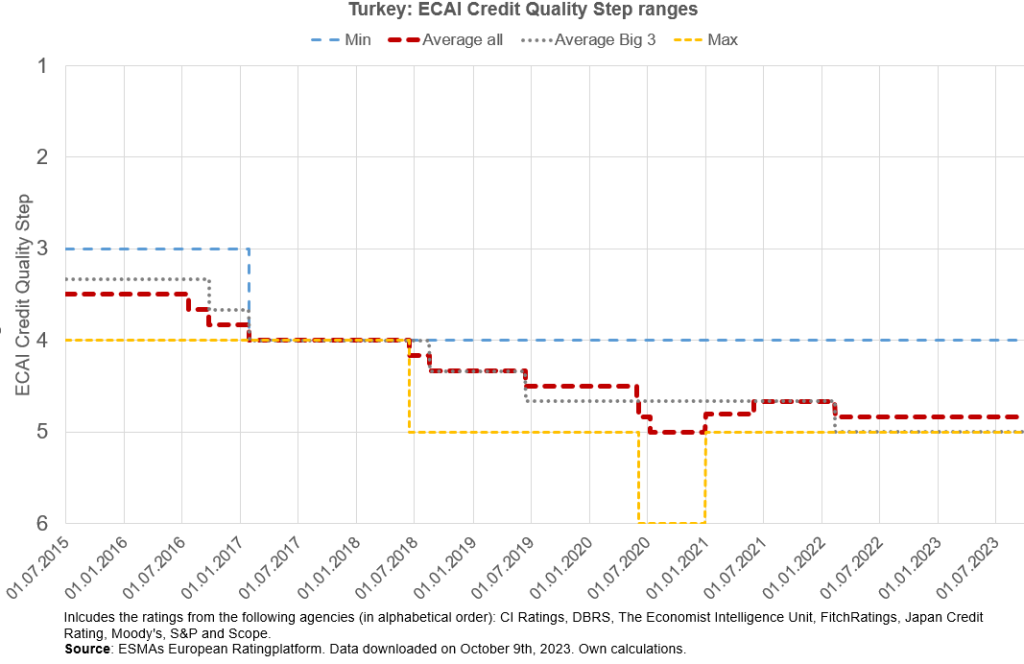

ECAI Credit Quality Steps analysis

The graph below outlines the evolution of Turkey’s credit ratings based on the ECAI credit quality steps applicable to banks in Europe which uses 6 steps. The credit ratings from the individual agencies was converted to these 6 ECAI steps using the mapping provided by the European Supervisory Authorities.

Given that the ECAI credit quality steps are less granular than the rating scales used by the rating agencies, fewer movements of the average quality appear. From July 2017, the average ECAI rating across all sources moved from 3,5 (the limit between step 3 – corresponding to BBB – and step 4 – corresponding to BB) to 4,83 indicating that nearly all agencies rate Turkey in credit quality step 5 (corresponding to B).

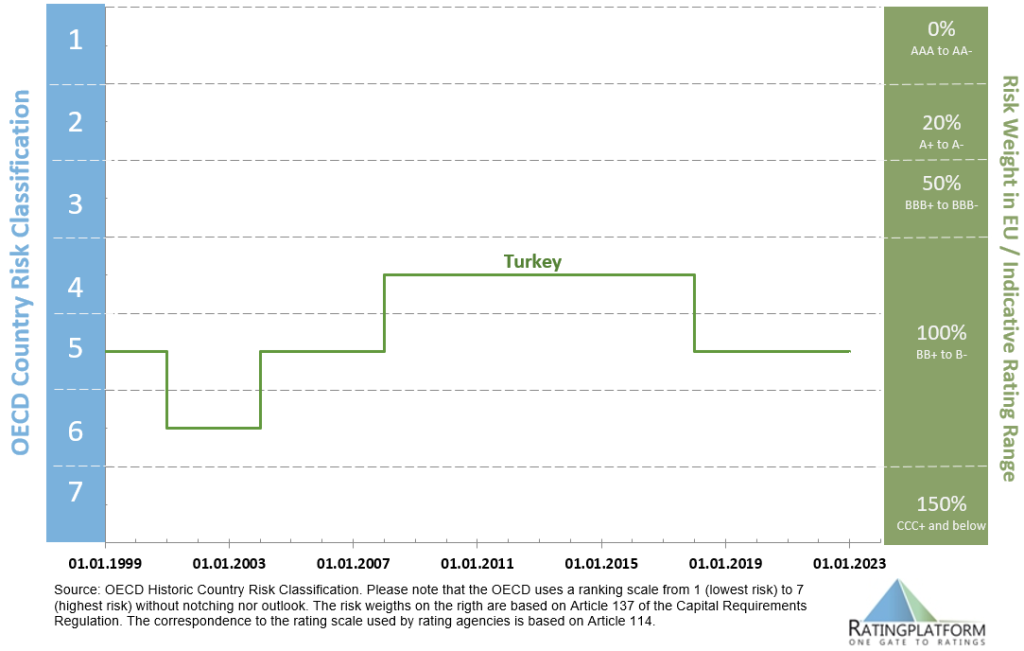

OECD Country Risk Classification

The OECD Country Risk Classification can be used in the European Union as an alternative approach to Credit Rating Agencies in order to derive risk weights in accordance with Article 137 of the Capital Requirements Regulation.

The OECD Country Risk Classification started in 1999 and covers nearly all countries in the world. The OECD uses a ranking system from 1 (highest credit quality) to 7 (lowest credit quality) and does not use outlooks. The OECD experts meet 3 times a year and review the ratings based on geographical groups on a yearly basis or when a rating action is required.

In the lens of the OECD, Turkey was classified between 4 and 6 and currently stands at 5.

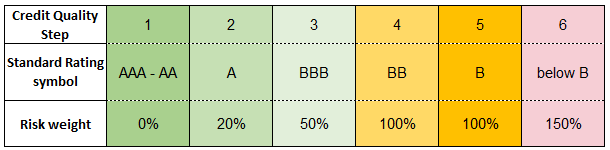

Risk weight approach

Article 114 (2) of the Capital Requirements Regulation foresees the following risk weights for exposures to Sovereigns outside of the European Union:

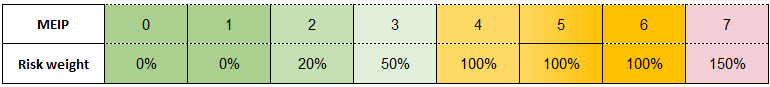

According to Article 137 of the Capital Requirements Regulation, the following risk weights apply to the OECD country risk classification based on the minimum export insurance premiums (MEIP) used for the country classification:

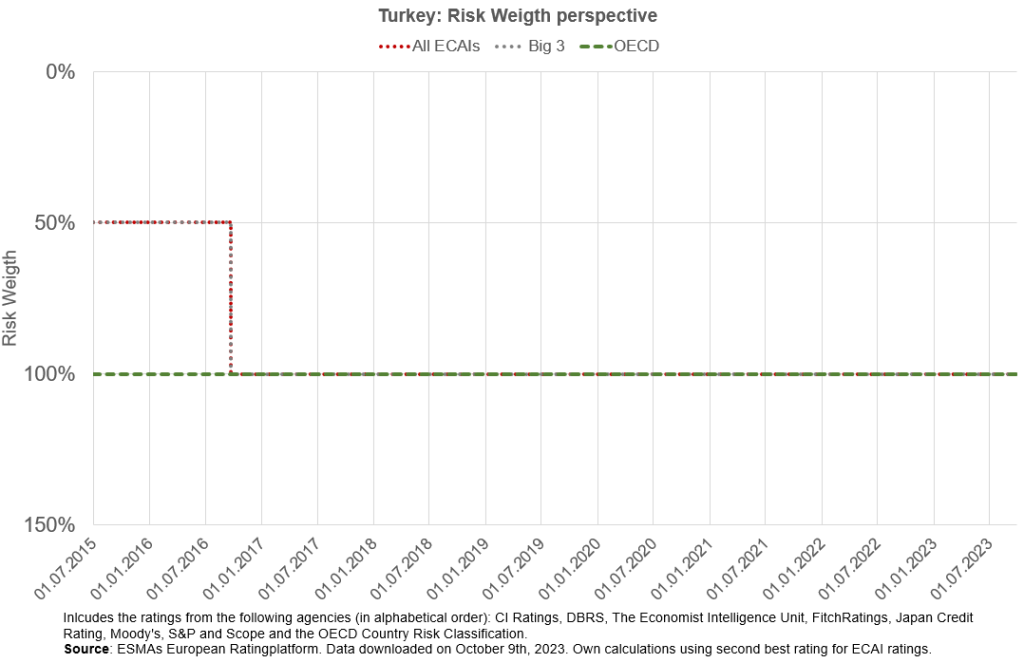

The graph below translates the ECAI credit quality steps ratings from the CRAs as well as the OECD classification into the risk weights used in the banking regulation for sovereign exposures:

As can be seen, since July 2016, Turkey’s debt would trigger a 100% risk weight independent from which sources are being used.