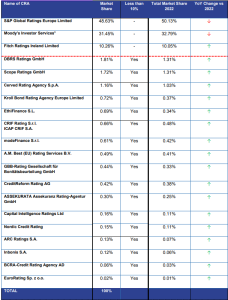

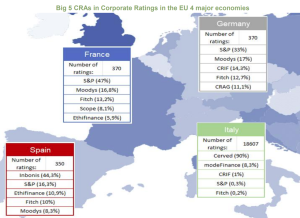

EU CRAs market shares for 2022

On December 20th, 2023, the European Securities and Markets Authority (“ESMA”), the supervisor of Credit Rating Agencies (“CRAs”) in the

In September 2009, the European Parliament and the Council of Ministers adopted the regulation on Credit Rating Agencies (1060/2009) (hereafter “CRA regulation”) defining the regulatory regime applicable to Credit Rating Agencies („CRA“). This regulation was amended in 2010 in order to take into account the set up of the European Securities and Markets Authority (“ESMA”), solely responsible for the on-going supervision of CRAs from July 1st, 2011.

In November 2011, the EU Commisssion tabled a new legislative proposal on Credit Rating Agencies (called “CRA III” thereafter). After negotiations between the European Parliament, the Council of Ministers and the EU Commission a compromise text was reached in December 2012. The CRA regulation entered into force on June 20th, 2013.

Article 3 (1) a of the CRA regulation provides the following definition of credit ratings: ‘credit rating’ means an opinion regarding the creditworthiness of an entity, a debt or financial obligation, debt security, preferred share or other financial instrument, or of an issuer of such a debt or financial obligation, debt security, preferred share or other financial instrument, issued using an established and defined ranking system of rating categories;

According to Article 2 of the CRA regulation, rating agencies need to register with ESMA so that their ratings can be used for regulatory purposes. The list of registered or certified rating agencies in Europe can be looked up at ESMA’s website.

Not covered by this regulation are private credit ratings, credit scores, credit ratings from export credit agencies (see below) and credit ratings from central banks.

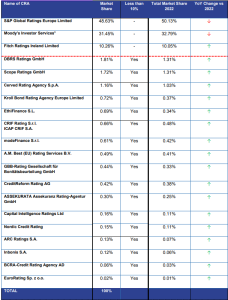

EU agencies registered or certified as Credit Rating Agency under Regulation 1060/2009 or exempted from registration in alphabetical order

According to Article 4 of the CRA Regulation the following market participants MAY use ratings for regulatory purposes:

Credit institutions as defined in Directive 2006/48/EC,

investment firms as defined in Directive 2004/39/EC,

insurance undertakings subject to the First Council Directive 73/239/EEC of24 July 1973 on the coordination of laws, regulations and administrative provisions relating to the taking-up and pursuit of the business of direct insurance other than life assurance

assurance undertakings as defined in Directive 2002/83/EC of the European Parliament and of the Council of 5 November 2002 concerning life assurance, reinsurance undertakings as defined in Directive 2005/68/EC of the European Parliament and the Council of 16 November 2005 on reinsurance,

undertakings for collective investements in transferable securities (UCITS) as defined in Directive 85/611/EEC

institutions for occupational retirement provisions as defined in Directive 2003/41/EC

Alternative investment funds as defined in Directive 2011/61/EU

Central counterparties authorized in accordance with Regulation 2012/648/EU

The EU CRA regulation takes into account ratings issued in third countries in two different ways: endorsement (Article 4.3) or equivalence (Article 5).

Article 5 relates to Credit Rating Agencies established in third countries and allows the use of credit ratings issued by these agencies if the following conditions are met:

Article 4.3 (endorsement procedure) relates to credit ratings issued in third countries by ESMA registered CRAs.

Currently, ratings issued in the following countries may be endorsed by European registered rating agencies: Argentina, Australia, Brazil, Canada, Hong Kong, Japan, Mexico, Singapore, the United Kingdom and the United States.

Out of the EU registered CRAs, the following agencies may be using the endorsement mechanism: AM Best, DBRS, FitchRatings, Moody’s and Standard & Poor’s.

Whereas the first European regulations on Credit Rating Agencies did not further define how the above users should use the ratings, the CRA III regulation includes 2 important provisions:

The newly adopted Capital Requiremenst Directive and Capital Requirements Regulation relating to financial institutions in Europe introduces two important changes relating to Credit Rating Agencies: these shall receive automatically the status of External Credit Assessment Institution (“ECAIs”; see below) – the new status shall be an European wide one.

On December 20th, 2023, the European Securities and Markets Authority (“ESMA”), the supervisor of Credit Rating Agencies (“CRAs”) in the

On November 13th, 2023, the European Supervisory Authorities (“ESAs”), composed of EBA, ESMA and EIOPA, published their final report on

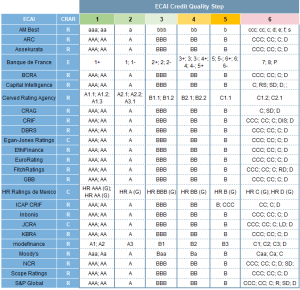

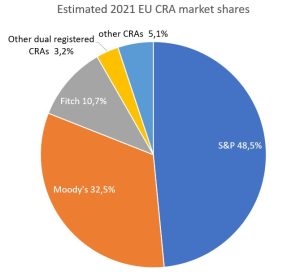

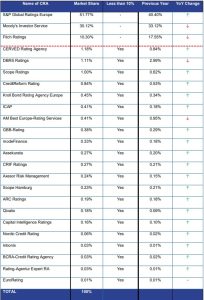

The above graph outlines the largest credit rating agencies in (non-financial) corporate ratings measured against the number of ratings outstanding

Article 8d of the EU Regulation on Credit Rating Agencies, requires issuers and related third parties intending to appoint at

On December 22nd, 2021, ESMA published the report for the year 2020:

On June 28th, 2013, the so called “CRD IV Package” relating to the Capital Requirements of financial institutions was adopted

Legal Background Whereas credit assessments from Export Credit Agencies (“ECA”) are not covered by the CRA regulation, the directive 2006/48/EC