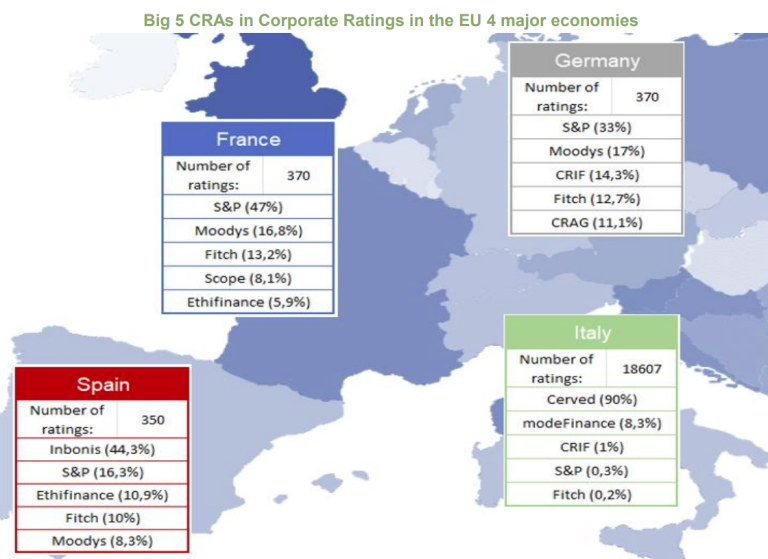

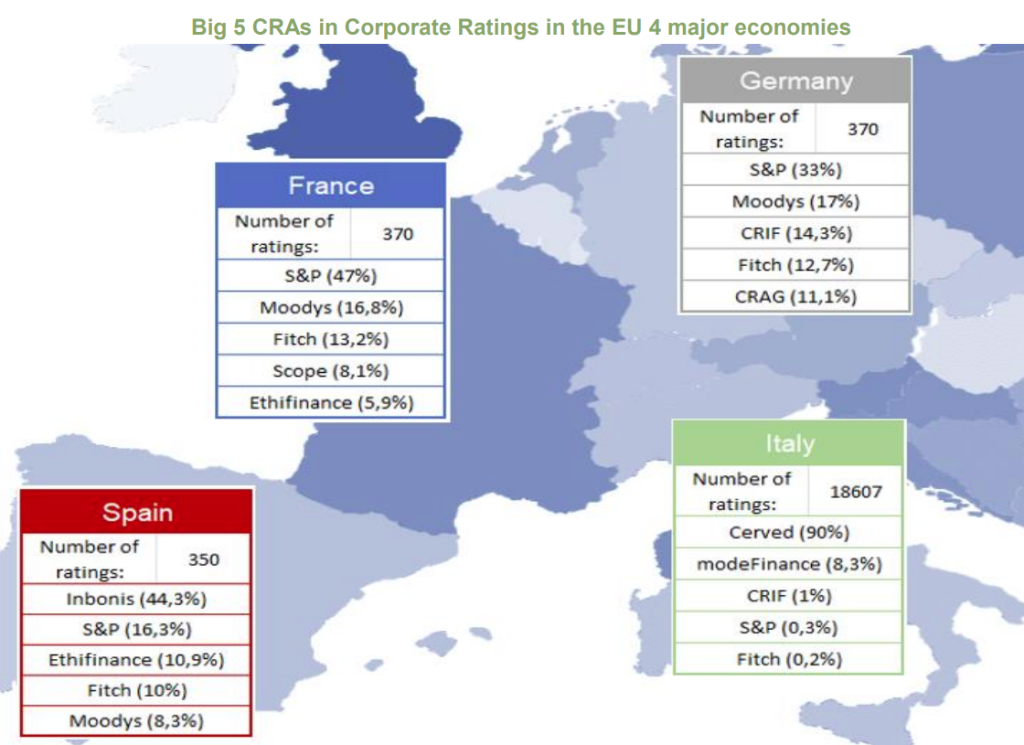

The above graph outlines the largest credit rating agencies in (non-financial) corporate ratings measured against the number of ratings outstanding end of 2022 in the EU major economies France, Germany, Italy and Spain.

The rating data used for this research are based on ESMAs Central Repository of Ratings (“CEREP”) freely available to all users following this link.

While the number of ratings outstanding in France, Germany and Spain are around 370 ratings, Italy strikes out with a total of 18.607 ratings outstanding as of December 2022.

Italy

In Italy, Cerved Rating Agency clearly dominates the market as it accounts for 90% of all ratings on non-financial corporates. Cerved Rating Agency has been an ECAI since 2008 and operates mainly under the investor-pays model upon request of banks. Cerved Rating Agency has been nominated by several large European banks as ECAI for its coverage of Italian corporates.

modeFinance is the second player in Italy measured against number of ratings outstanding. While modeFinance used to have a limited coverage, the agency substantially increased the number of ratings outstanding over the last 2 years.

CRIF is a rating agency originating from Italy. Over the last 2 years, CRIF substantially extended its coverage beyond Italy only.

Spain

Inbonis leads the market in Spain based on number of ratings outstanding. Inbonis is a relatively new agency with a special focus on Small and Medium-sized Companies.

EthiFinance is the result of the merger of Spanish rating agency Axesor and the French agency Spreadresearch. EthiFinance in Spain provides an extensive coverage of the Spanish mid-cap market.

Germany

In Germany, the Dominant 3 agencies (S&P, Moody’s and Fitch) dominate the market. But CRIF already ranks third in terms of number of ratings. Additionally, Creditreform Rating (CRAG) is not far behind Fitch.

Creditreform Rating (“CRAG”) is a German agency having substantially expanded its rating coverage across the EU on non-financial corporates and banks.

France

The French market is dominated by S&P, who accounts for nearly half of all ratings. Moody’s and Fitch come second and third in terms of number of ratings assigned. Scope ranks fourth. Scope Ratings is an agency originating from Germany who substantially expanded its coverage across market segments and countries.

For the sake of completeness, Banque de France is an eligible ECAI in France. Banque de France makes available to French Banks its vast rating coverage through FIBEN.

Summary

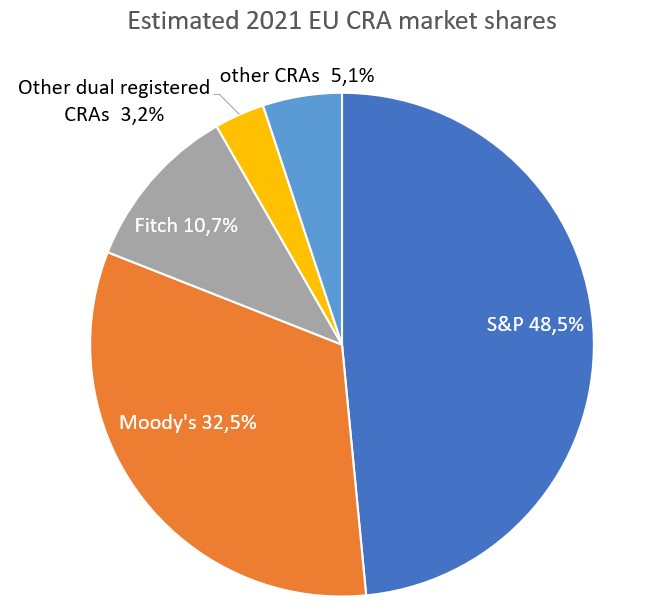

This analysis shows that the Big 3 agencies play an important role in non-financial corporate ratings but that these are not the only providers. Issuers seeking a rating should therefore familiarize themselves with the high number of players on the market. Given that the market is evolving dynamically, issuers should regularly review the market and their choice of rating agency.