We are pleased to announce the publication of our report “Corporate Credit Ratings – Review of ESMA registered Credit Rating Agencies (CRAs) rating activity and performance for the period 2013 to 2022”.

Overview over the report

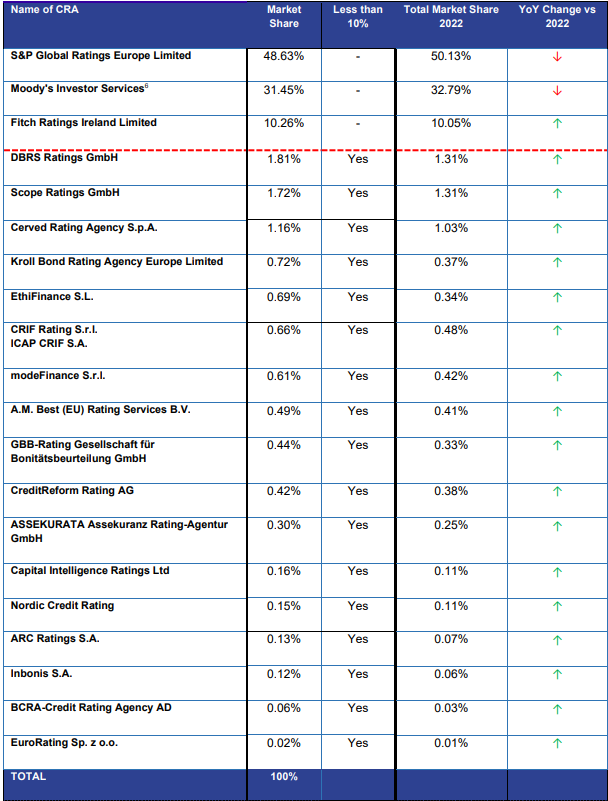

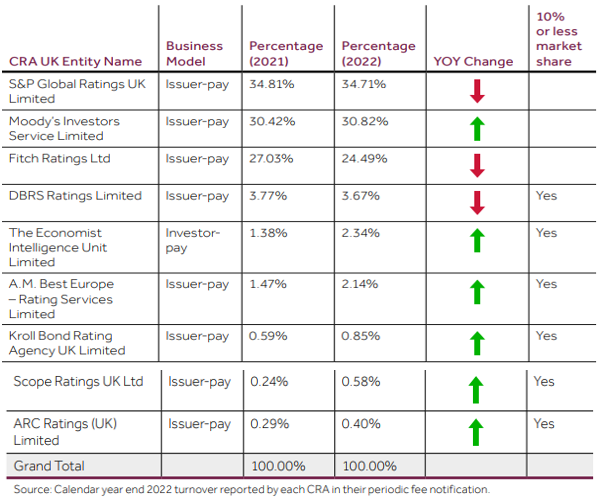

This report covers a total of 20 credit rating agencies registered with ESMA, the sole supervisor of credit rating agencies across the EU.

In this report, we focus on non-financial corporate ratings (it does not cover banks and insurances) for the prioed 2013 to 2022. For selected agencies, we provide additional data going back until 2005.

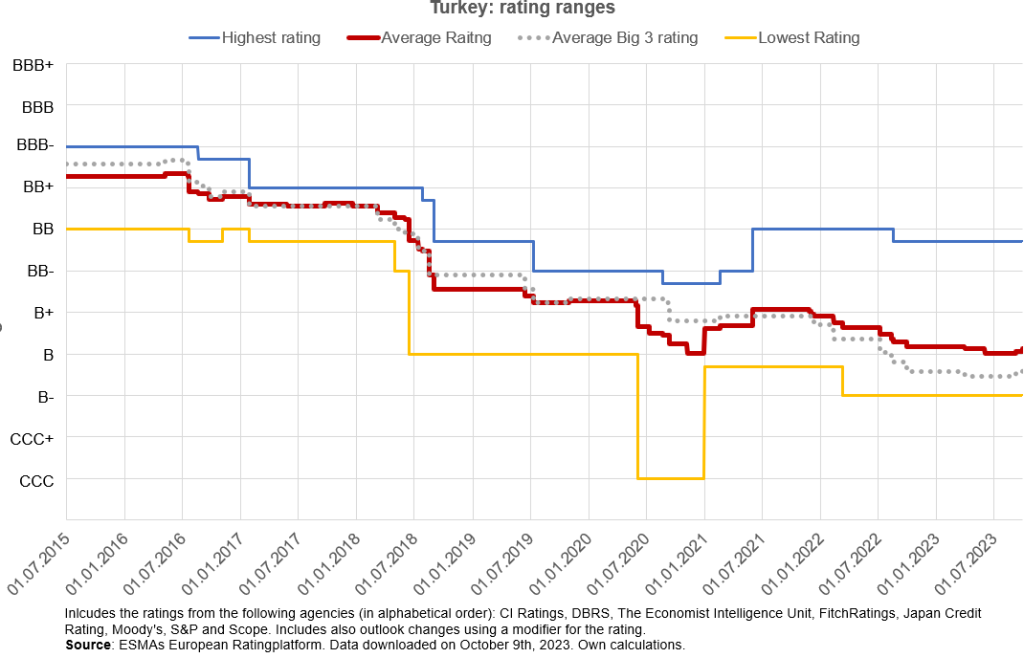

Our report analyzes the rating activity of credit rating agencies on a yearly basis as well the rating transitions and the rating performance (default rates, cumulative accuracy profiles). The analysis is carried out based on the rating agencies rating scales but also on ECAI credit quality steps used for regulatory purposes.

Our report is a unique research document providing detailed information on each rating agency. Additionally, we have carried out a cross-agency analysis covering the whole corporate ratings market. The report is based on global rating activity data, some information focusing solely on the ratings linked to EU issuers.

The report is largely based on the rating data available at the Central Repository of Ratings (“CEREP”) as mantained by ESMA. Kindly note that this database is available for free to all users. In order to carry out this analysis, we carried out between mid July and end August 2023 around 1 500 separate downloads from CEREP to gather the data for 2013 to 2022 . Data relating to the period 2005 to 2012 was downloaded already in July 2013 and reused in this report.

Who should read this report

This report is of interest to all users of credit ratings as defined in Article 4 (1) of EU Regulation 1060/2009, which include credit institutions, investment firms, insurance undertakings, institutions for occupational reitrement provision, management companies, investment companies, alternative investment fund managers and central counterparties.

In view of the Basel III reform in Europe and the introduction of the so called output floor, credit institutions and investment firms may be particularly interested in this report in order to assess the potential impact on capital requirements over time.

This report is also of interest to credit rating agencies in order to get a good overview over the whole market and the performance of the own but also other agencies using objective comparison criteria.

The report is also very usefull for advisors (financial advisors, rating advisors) as it represent a unique source of information regarding credit rating agencies active on the European market.

Price and Terms of use

The report costs EUR 1.740,- excluding VAT. If you are interested in detailed yearly data for a specific agency, we charge EUR 150,- per Agency and shall provide this information as an Annex to the report.

This report is for the use of the acquirer and should not be disclosed in whole or in part to any third party without the prior written consent from RATINGPLATFORM. You may disclose up to 3 graphs from this report to your user by duly stating as source of the report “Ratingplatform: Corporate Credit Ratings – review of ESMA registered CRAs rating activity and rating performance for the period 2013 to 2022. (dated September 2023, available at www.ratingplatform.com)”