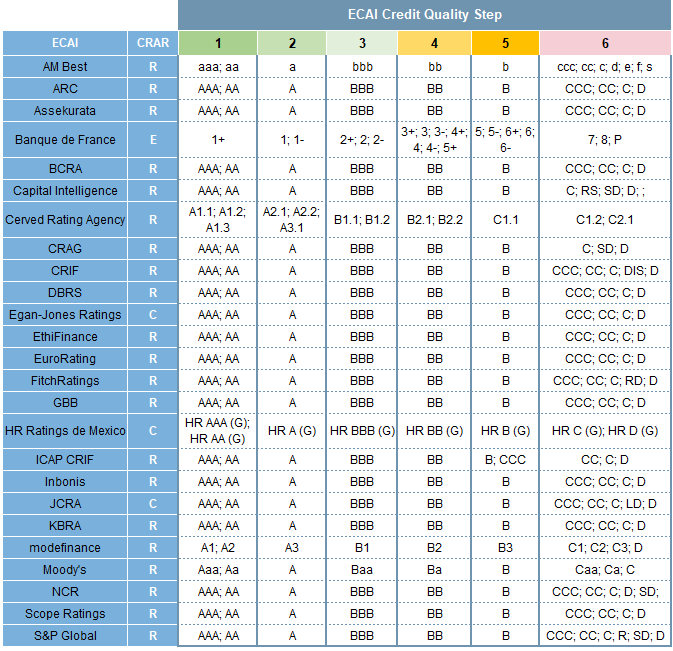

On November 13th, 2023, the European Supervisory Authorities (“ESAs”), composed of EBA, ESMA and EIOPA, published their final report on the mapping of ECAIs ratings to the regulatory credit quality steps.

The below table provides an overview over the mapping of the main long term rating scales used by all ECAIs under the banking regulation using 6 credit quality steps:

The table mentions the registration status of the respective ECAI under the Credit Rating Agency Regulation (“CRAR”): “R” stands for registered agency; “C” stands for certified agency and “E” stands for exempted from registering (the later applying only to Banque de France, which is the only central bank having an ICAS having been recognized as ECAI).

With respect to certified agencies, we allow to recall that ratings on EU issuers issued by these agencies are not usable for regulatory purposes in the EU.

Compared to the currently applicable mapping of credit ratings, the following changes have occurred:

- Ratingagentur Expert RA is no longer on the list as this agency is no longer registered as CRA with ESMA.

- Axesor Rating and Qivalio are equally no longer on the list as these two agencies have been merged into EthiFinance

- The mapping of Creditreform Rating (“CRAG”) has been modified to the “standard” mapping. Currently, ratings in the BBB and BB categories mapped one step lower.

- The mapping of ICAP CRIF has been equally modified. Categories AAA, AA and A are currently mapped one step lower, while categories B and CC currently mapped one step higher. The now foreseen mapping of ICAP CRIF corresponds to the “standard” mapping with the exception of CCC ratings mapping one step higher than usually.

This mapping of ratings needs now to be endorsed by the European Commission, which may take up to 6 months.

Useful links

Final report under the banking regulation

Final report under Solvency II (insurances)