On June 28th, 2013, the so called “CRD IV Package” relating to the Capital Requirements of financial institutions was adopted and entered into force on January 1st, 2014. This package includes key changes relating to External Credit Assessment Insititutions (“ECAIs”) status:

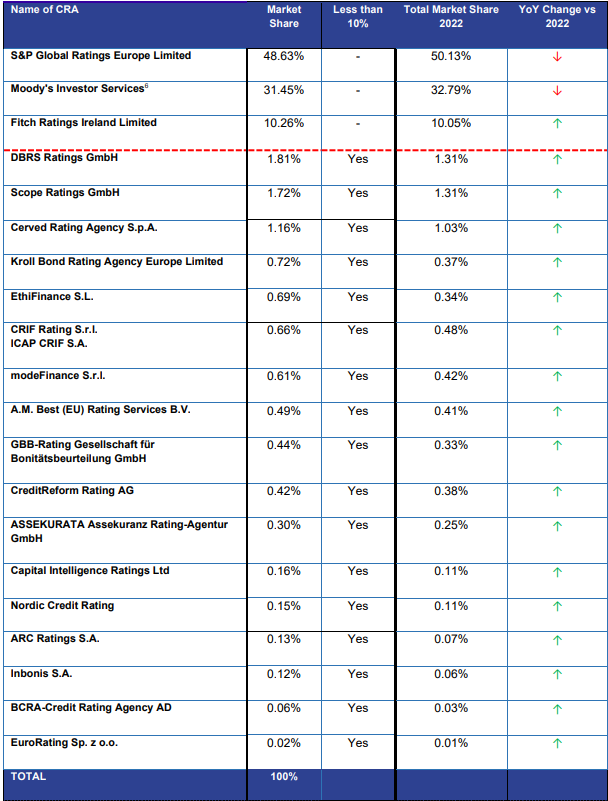

- all registered or certified CRAs to be automatically recognized ECAIs,

- the ECAI status will be an EU wide one.

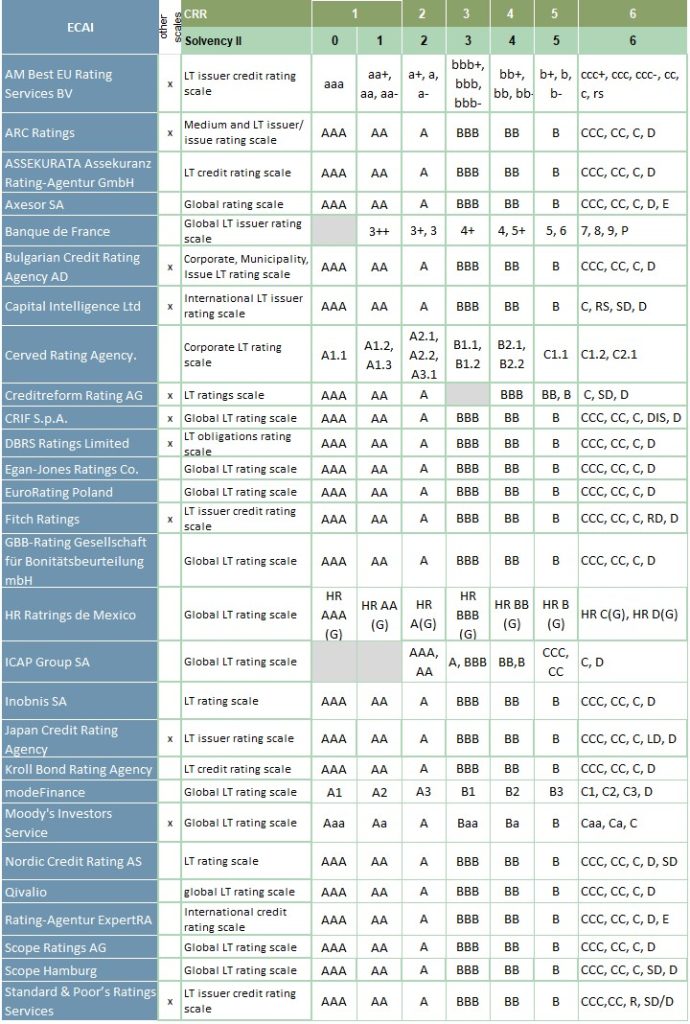

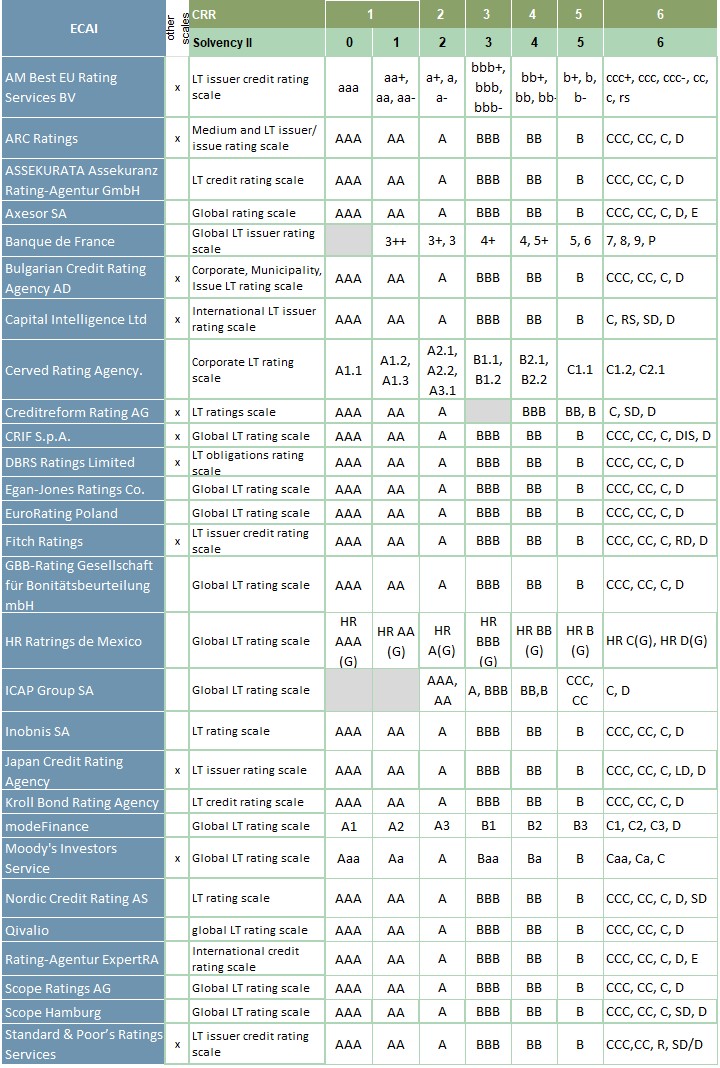

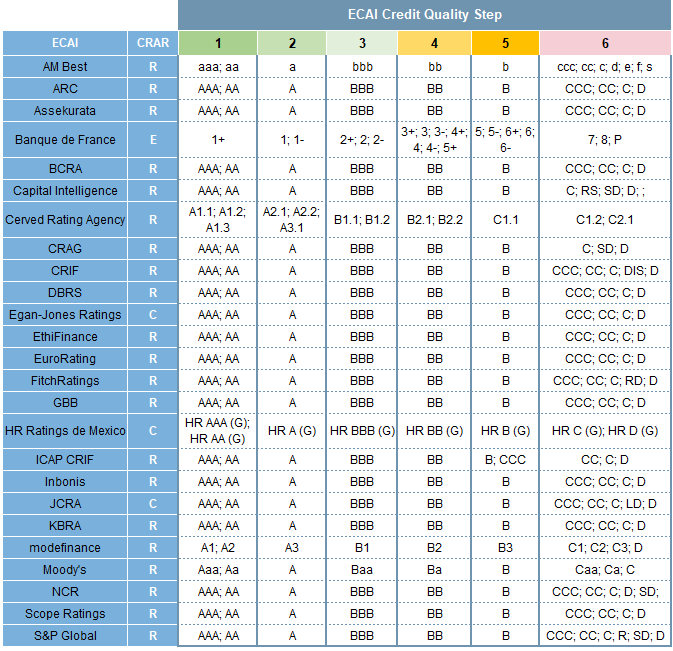

- the Mapping of ratings to the 6 ECAI credit quality steps under CRR and the 7 steps under Solvency II should be done by the European Supervisory Authorities.

Article 4 (98) of the EU Regulation 575/2013 (CRR) defines ECAI as a credit rating agency that is registered or certified in accordance with Regulation (EC) 1060/2009 of the European Parliament and the Council of 16 September 2009 on credit rating agencies or a central bank issuing credit ratings which are exempt from the application of Regulation (EC) 1060/2009.

According to Article 136 on the Mapping of ECAIs credit assessments, the Joint Committee of the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA) shall develop draft implementing technical standards to specify for all ECAIs, with which of the credit quality steps set out in Section 2 the relevant credit assessments of the ECAI correspond (mapping).

On October 12th, 2016, the European Commission adopted Implementing Regulations regarding the mapping of ECAI ratings, covering a total of 26 ECAIs. These implementing reegulations were amended in April 2018, November 2019 and 17th November 2021.

The 2021 update introduces the “standard mapping” for two additional Credit Rating Agencies: Nordic Credit Ratings (registered with ESMA as CRA since August 2018) and Inbonis SA (registerd as CRA since May 2019). Additionally, the mappings of ratings for Credireform Rating AG and GBB-Rating has been modified. The detailed mapping is available following this link.