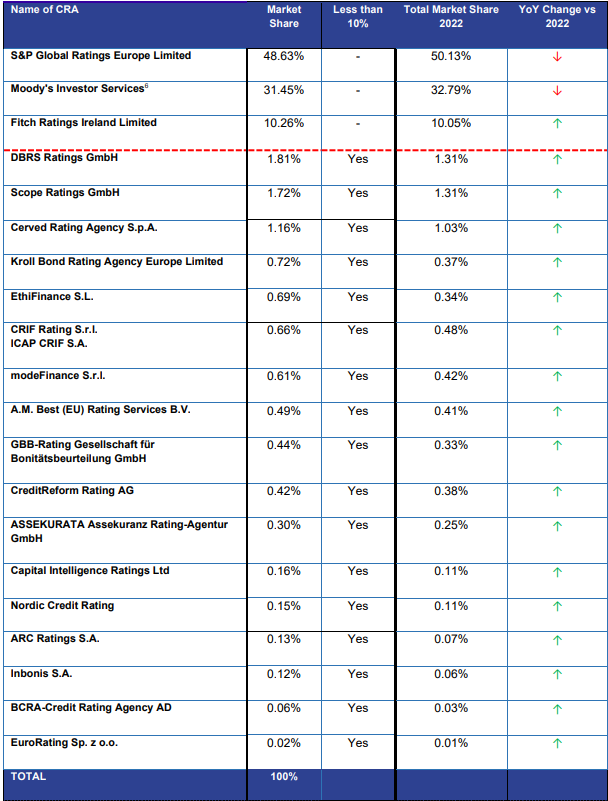

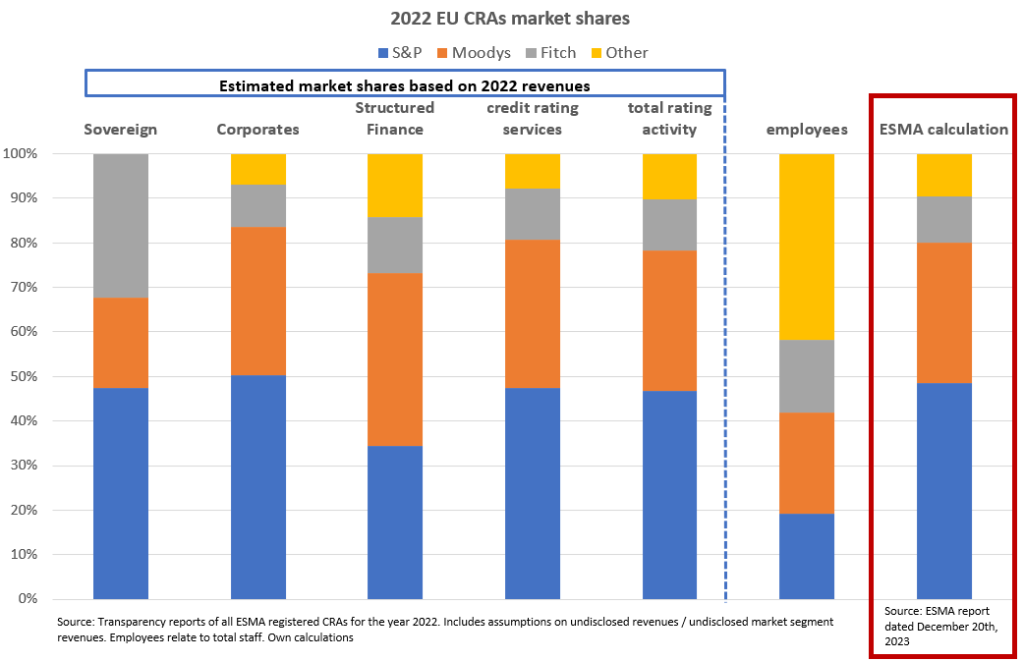

On December 20th, 2023, the European Securities and Markets Authority (“ESMA”), the supervisor of Credit Rating Agencies (“CRAs”) in the EU published the annual market shares report for the year 2022. According to ESMA, the market shares are as follows:

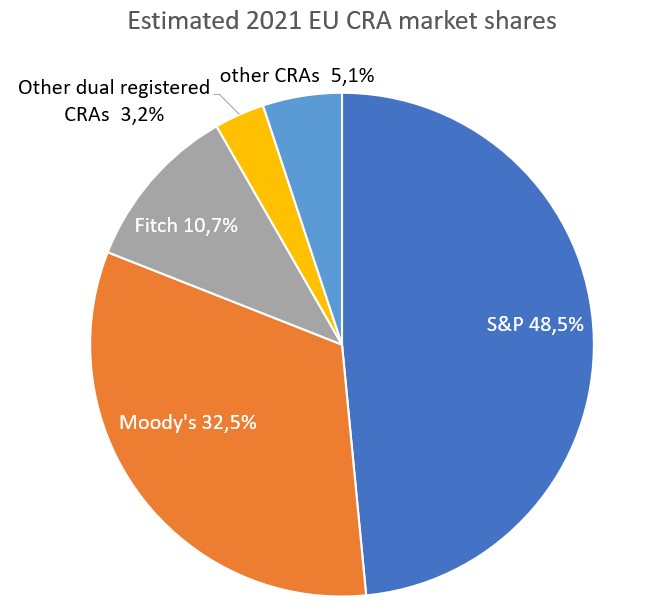

We have reviewed the annual transparency reports for 2022 for all ESMA registered agencies. We estimate that the EU CRA market generated revenues reaching approximately EUR 1 billion in total, the Corporate market segment (covering banks, insurances and non-financial corporates) accounting for approximately 76%, the Structured Finance market contributing 17% and the remaining linked to the sovereign market.

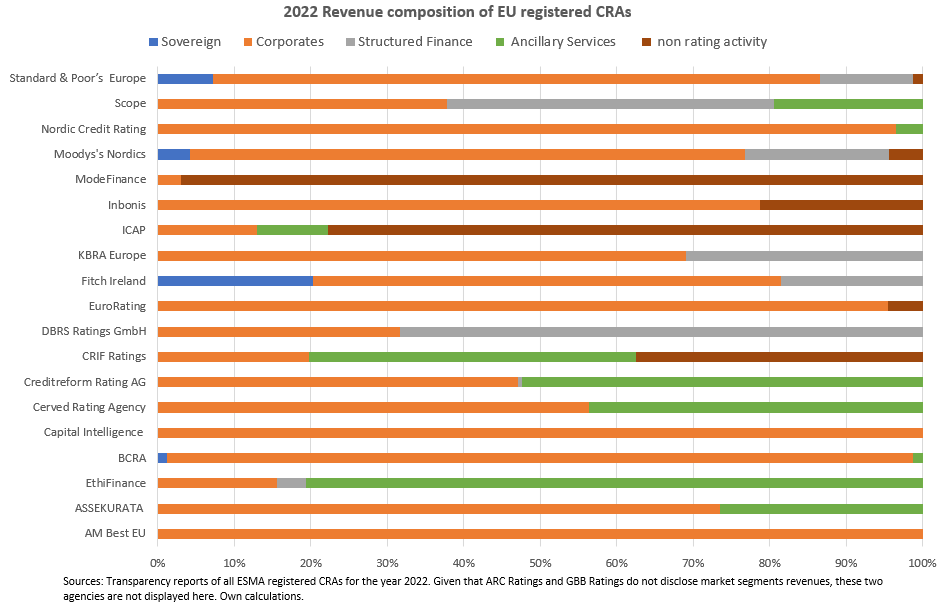

The below chart illustrates the revenue composition of the different agencies:

When comparing the ESMA calculations with the information disclosed by the different CRAs, we find the following:

In the sovereign segment, the Dominant 3 account for nearly the whole market, implying that other CRAs provide their ratings on an unsolicited / unpaid basis. In the Structured Finance market, small CRAs have a combined share of 14,2% – this may be due to the fact that SF instruments require 2 ratings and Article 8d mandates considering a small agencies in case 2 are selected.

In terms of employees, small CRAs account together for nearly 42% of the staff employed in the CRA business in Europe.

Useful links